Long-Term-Care Costs Continue to Increase

10/06/2015 06:00AM | 14028 viewsAyo Mseka, Editor-in-Chief of NAIFA’s Advisor Today magazine

Genworth’s “2015 Cost of Care” study shows a continuing rise in the amount of financial resources spent on Americans in their later years. The study notes that the cost of receiving care in an assisted-living facility or a nursing home is dramatically increasing, while the cost to receive care at home is rising more gradually.

“There is something very difficult about facing some of the challenges and issues that come with aging, including the high costs of long-term care services,” said Tom McInerney, Genworth’s president and CEO. “Part of our mission at Genworth with the Cost of Care study is to continue educating Americans on how to have tough conversations around long- term care and the importance of planning. In fact, last year we embarked on a journey to help facilitate these discussions through our “Let’s Talk national initiative.”

The 2015 median hourly cost for the services of a homemaker or home health aide hired from a home-care agency is $19.50 and $20, respectively. Homemaker costs have risen on average 1.6 percent annually over the past five years, while home health aide services have risen, on average, one percent annually over the past five years.

The cost to receive care in an assisted-living facility is rising at a much faster rate. The median annual cost for care in an assisted-living facility is $43,200, which represents an average increase of 2.5 percent over the past five years. The comparable cost for a private nursing home room is $91,250, which has increased 4 percent annually over the past five years.

Millennials’ reaction to long-term-care issues

In further examining how Americans perceive this issue, Genworth commissioned a complementary study, “Aging Across Generations.” The research was aimed at understanding to what extent Millennials, Baby Boomers and older generations are familiar with long-term-care events and how prepared they are for their own future.

Millennials have witnessed some of the challenges the older generations have faced, such as stock market swings, a troubled economy and high unemployment, and are learning about the importance of planning and taking proactive steps to plan for their future.

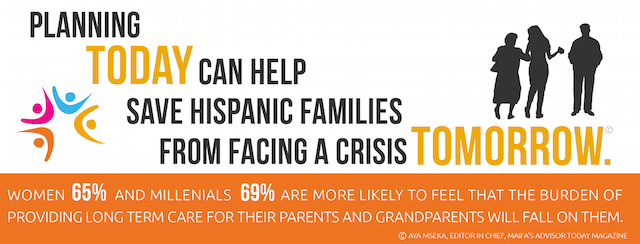

Part of the reason Millennials are driving the conversation is to make sure that there is a plan, and that their families can have a sense of security if a long-term-care event should occur. The study revealed that females (65 percent) and Millennial generations (69 percent) are more likely to feel that the burden of providing long-term care for their parents or grandparents will fall on them.

Generally, as adults age, they become more familiar with long-term-care events and they know more people who may have gone through a care issue. However, almost half of adults and about a quarter of Millennials assign a failing grade to their parents or loved ones for not planning for, or talking about, their long-term-care needs.

Millennials (56 percent) think they will plan for their long-term-care needs more effectively than previous generations did because they are better informed and have better resources available to them.

Planning today can help save families from facing a crisis tomorrow, Genworth notes. Having the right talk in the right way and at the right time can ease the emotional and financial pressures of planning for long-term- care needs. Knowing the cost of long-term-care services and financing options can also help Americans age gracefully in the setting in which they are the most comfortable.

Options available

Genworth also provided the following information to help you learn what financing options are appropriate for your needs:

*Medicare pays for long-term care if you require skilled services or rehabilitative care, such as in a nursing home (max 100 days), and at home, if you are also receiving skilled home health or other skilled in-home services (provided for a short period of time). For more information, visit longtermcare.gov.

*Medicaid covers a large share of long-term-care services, but to qualify, your income must be below a certain level, and you must meet minimum state-eligibility requirements. For more information, visitlongtermcare.gov.

*If you qualify, private payment options, such as long-term-care insurance, linked-benefits products or long-term-care riders on other insurance can help fill the gap between public assistance and the high cost of long-term- care services. For more information please visit longtermcareinsurance.org.

Genworth's annual “Cost of Care Survey” covers nearly 15,000 long-term- care providers nationwide. The company annually surveys the cost of long- term care to help Americans plan for the potential cost associated with the various types of long-term care available in their preferred location and setting. The 2015 survey was conducted in January and February 2015.

Genworth Financial, Inc. is a Fortune 500 insurance holding company committed to helping families become more financially secure, self-reliant and prepared for the future.

Post your Comment

Please login or sign up to comment

Comments